Fast and Reliable Mobile Locksmith Services in Denver

Here’s what you should know about mobile locksmith services, their benefits, and how to choose the right locksmith for your needs in Denver. Get more information: https://emergencylocksmithdenv....er.com/mobile-locksm

#denvermobilelocksmith

#mobilelocksmithdenver

#mobilelocksmithdenverco

Menemukan postingJelajahi konten menawan dan beragam perspektif di halaman Temukan kami. Temukan ide-ide segar dan terlibat dalam percakapan yang bermakna

Transform your digital experience with SynapseIndia’s expert UI/UX development services! From mobile apps to Smart TV interfaces, our innovative designs are tailored to deliver seamless user journeys and drive engagement. With 24+ years of experience and expertise across platforms, we ensure your projects are in the best hands. Learn more at https://www.synapseindia.com/t....echnology/ui-ux-desi

#uiuxdesign #userexperience #uiuxdevelopment #synapseindia

The role of a business analyst is crucial in today’s data-driven organizations, where bridging the gap between business needs and technological solutions is key. The Microsoft Business Analyst Certification Course is designed to empower learners with the knowledge and tools necessary to thrive in this dynamic field.

https://www.indiaassignmenthel....p.com/courses/micros

buy abortion pill pack USA

At Abortionprivacy, we provide discreet, safe, and reliable access to FDA-approved medicines. Buy abortion pill pack Kit with credit card and enjoy a special 50% discount on your order today with free shipping. Buy mifepristone, and misoprostol kit online and prioritize your reproductive health with confidence!

https://www.abortionprivacy.com/abortion-pill-pack

Mazda Aftermarket Car Parts for Performance Upgrades from Japan

Discover premium Mazda aftermarket car parts sourced directly from Japan. Shop Mazda parts online for enhanced performance, reliability, and style. Perfect for enthusiasts and tuners, our selection meets your needs with quality and affordability. Read more to find the best upgrades for your Mazda today! https://rtheorymotorsports.has....hnode.dev/enhance-yo

Prickly Pear Oil For Face

Treat your skin to the rich benefits of prickly pear oil for face by Morganna's Alchemy Laboratories. This oil is packed with antioxidants and essential fatty acids to restore hydration, reduce fine lines, and promote a healthy, radiant complexion. Perfect for all skin types, it absorbs quickly and leaves your skin feeling soft and rejuvenated. Give your face the care it deserves with this rejuvenating oil from Morganna's Alchemy Laboratories.

VISIT US : https://www.morgannasalchemy.c....om/product/prickly-p

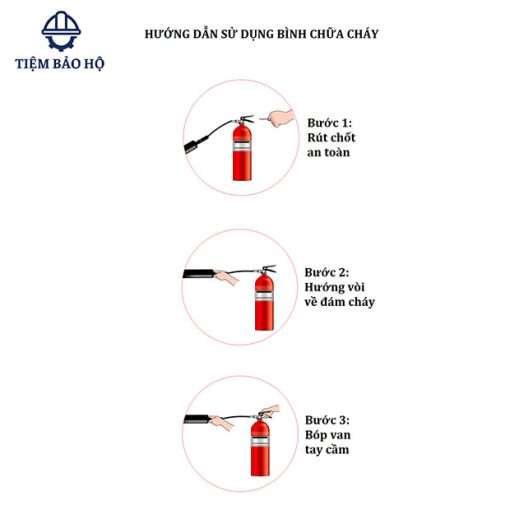

Tại Sao Mỗi Gia Đình Nên Có Một Bình Cứu Hỏa Trong Nhà

Việc mỗi gia đình nên có một bình cứu hỏa trong nhà là rất quan trọng vì những lý do sau đây:

Bảo vệ tính mạng: Hỏa hoạn có thể xảy ra bất ngờ và lan nhanh. Bình cứu hỏa giúp bạn nhanh chóng dập tắt ngọn lửa, bảo vệ tính mạng của các thành viên trong gia đình.

Giảm thiệt hại tài sản: Nếu phát hiện hỏa hoạn kịp thời và có bình cứu hỏa trong tay, bạn có thể ngăn chặn ngọn lửa lan rộng, giảm thiệt hại về tài sản.

An toàn cho trẻ nhỏ: Trong gia đình có trẻ nhỏ, việc trang bị bình cứu hỏa giúp giảm rủi ro và bảo vệ các em khỏi những tình huống nguy hiểm.

Dễ sử dụng: Hiện nay, bình cứu hỏa được thiết kế đơn giản, dễ sử dụng. Với hướng dẫn rõ ràng, bất kỳ ai cũng có thể sử dụng để xử lý sự cố.

Giá cả hợp lý: Bình cứu hỏa không phải là một khoản đầu tư lớn, nhưng nó có thể cứu mạng sống và bảo vệ tài sản quý giá của gia đình bạn.

Tuân thủ quy định pháp luật: Ở nhiều nơi, việc trang bị bình cứu hỏa trong nhà là yêu cầu bắt buộc, đặc biệt là đối với các hộ gia đình ở khu vực có nguy cơ cháy cao.

Tăng cường ý thức phòng cháy chữa cháy: Sở hữu bình cứu hỏa cũng giúp nâng cao nhận thức về an toàn phòng cháy chữa cháy trong gia đình, khuyến khích mọi người chủ động phòng tránh nguy cơ cháy.

Vì những lý do trên, mỗi gia đình nên xem xét việc trang bị bình cứu hỏa và thường xuyên kiểm tra, bảo trì để đảm bảo thiết bị luôn trong tình trạng hoạt động tốt.

Việc mỗi gia đình nên có một bình cứu hỏa trong nhà là điều hết sức cần thiết và quan trọng. Bình cứu hỏa không chỉ là một thiết bị an toàn, mà còn là một công cụ hữu ích giúp ngăn chặn và dập tắt nhanh chóng những đám cháy nhỏ, bảo vệ tính mạng và tài sản của gia đình. Trong bối cảnh tình hình cháy nổ ngày càng gia tăng, việc trang bị bình cứu hỏa có thể giúp gia đình chủ động ứng phó với những tình huống khẩn cấp. Ngoài ra, việc nâng cao nhận thức về phòng cháy chữa cháy và cách sử dụng bình cứu hỏa cũng nên được chú trọng, để mỗi thành viên trong gia đình đều có thể thực hiện đúng các biện pháp an toàn khi cần thiết. Tóm lại, đầu tư vào một bình cứu hỏa là một hành động khôn ngoan và cần thiết, góp phần tạo nên một môi trường sống an toàn hơn cho tất cả mọi người trong gia đình. Mọi thông tin xin gửi về Tiệm Bảo Hộ để được giải đáp.

Website: https://tiembaoho.com

Tiktok: https://www.tiktok.com/@tiembaoho

Sdt: 032.8638.776

Email: tiembaoho@gmail.com

Đ/c: 123/7 Xuân Phương, Phương Canh, Nam Từ Liêm, Hà Nội"