Higher education is a significant investment in your future, but it often comes with a hefty price tag. Many students require financial assistance to cover tuition fees, living expenses, and other educational costs. In this digital age, a student loan app can be a valuable tool to help you secure the financial support you need. This article explores the benefits of using a student loan app and provides guidance on making the most of this resource.

The Role of a Student Loan App:

1. Access to Multiple Lenders: A student loan app connects you to a UrbanMoney, making it easier to explore various loan options and interest rates.

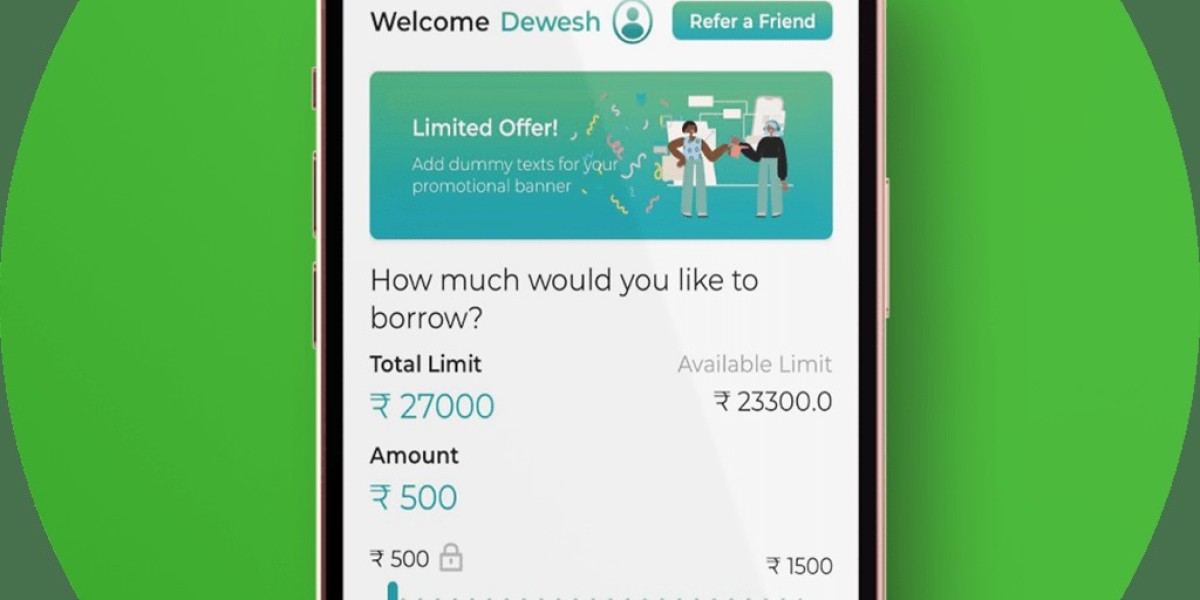

2. Simplified Application Process: These apps streamline the loan application process, allowing you to submit documents and information digitally, reducing paperwork and hassle.

3. Comparative Analysis: You can compare loan offers side by side, assessing factors like interest rates, repayment terms, and eligibility criteria to make an informed decision.

4. Financial Literacy Resources: Many student loan apps offer educational resources and tools to enhance your financial literacy, helping you understand the implications of borrowing and repayment.

Choosing the Right Student Loan App:

1. Reputation: Look for apps with a solid reputation and positive user reviews to ensure reliability and trustworthiness.

2. Lender Network: Ensure the app has partnerships with reputable lenders, including government-backed loan programs, private lenders, and credit unions.

3. User-Friendly Interface: The app should have an intuitive and user-friendly interface, making it easy to navigate and submit your loan application.

4. Security: Verify that the app employs robust security measures to protect your personal and financial information.

5. Customer Support: Access to responsive customer support is essential for addressing any questions or concerns during the loan application process.

Using a Student Loan App Effectively:

1. Research Thoroughly: Take the time to research and understand your loan options, including federal and private loans, grants, scholarships, and work-study programs.

2. Create a Budget: Develop a budget that outlines your educational expenses and how much you need to borrow. This will help you avoid overborrowing and accumulating unnecessary debt.

3. Compare Offers: Utilize the app's comparative tools to evaluate loan offers and choose the one that aligns best with your financial goals.

4. Read Terms and Conditions: Carefully review the terms and conditions of the loan, including interest rates, repayment schedules, and any potential fees.

5. Seek Financial Counseling: If you're unsure about your financial decisions, consider seeking guidance from a financial counselor or advisor to make informed choices.

Conclusion:

A student loan app can be a valuable companion on your journey to higher education. It simplifies the loan application process, provides access to multiple lenders, and offers financial education resources to empower you to make informed financial decisions. Remember to use the app wisely, research your options, and borrow responsibly to ensure a successful and financially secure academic journey.

For more info. visit us: