Custom Waterproof Seat Covers by Seat Cover USA

Protecting your vehicle’s interior from spills, moisture, and daily wear is essential for maintaining both comfort and value. Seat Cover USA offers premium custom waterproof car seat covers designed to deliver superior protection with a perfect fit.

visit us: https://ezinearticleblog.com/c....s-by-seat-cover-usa/

Discover postsExplore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

Custom Honda & Toyota Seat Covers by Seat Cover USA

A well-protected and stylish interior can significantly improve your driving experience. Seat Cover USA offers premium Custom Honda seat covers and Custom Toyota seat covers designed to deliver the perfect balance of protection, comfort, and style. Engineered for a precise fit, these seat covers are tailored to match the exact contours of Honda and Toyota models, ensuring a clean, factory-like finish.

visit us: https://tumblrblog.com/custom-....s-by-seat-cover-usa/

At Totally Frameless we have built our reputation as one of Melbourne’s most trusted glass pool fence and glass balustrade installation companies. Our focus is on providing our clients with the very best customer service, reliability and the highest quality products in our industry.

Our experienced sales and installation teams are dedicated to offering you the very best pool fencing, glass balustrades and frameless shower screens in Melbourne.

https://www.totallyframeless.com.au/

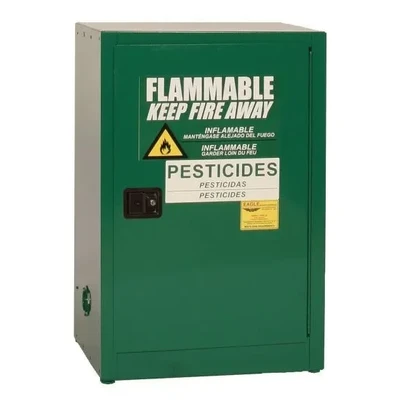

Secure Pesticide Storage Cabinets Designed for EPAWPS Pesticide Handling

Standard Pesticide Cabinets provide secure, regulation-ready storage for agricultural, industrial, and commercial pesticide use. Designed to support safe EPAWPS Pesticide Handling, these rugged steel cabinets feature lockable doors, corrosion-resistant shelves, and clear hazard identification to prevent unauthorized access and chemical cross-contamination. Ideal for farms, warehouses, and facilities that require dependable, compliant pesticide storage while protecting workers, the environment, and your operation.

Auto & Best Truck Seat Covers by Seat Cover USA

Protecting your vehicle’s interior is essential for maintaining comfort, style, and long-term value. Seat Cover USA offers premium auto seat covers designed to meet the needs of everyday drivers as well as truck owners who demand extra durability.

visit us: https://prfree.org/@seatcoveru....ver-usa-kzcwuh3cxoqh

Dive into Adventure in Marsa Alam

Experience the magic of Dolphin House marsa alam with marsa alam diving! Swim alongside playful dolphins and explore vibrant coral reefs with the expert guidance of deep south divers.

#seo #diving

https://deepsouthdiverseg.com/

Exclusive VIP Service at Ben Gurion Airport

Choose VIP service at Ben Gurion Airport for a refined travel experience from start to finish. Professional airport staff assist with fast-track formalities, luggage support, and smooth terminal navigation. Perfect for families, executives, and frequent travelers, this service saves valuable time while offering privacy, convenience, and peace of mind throughout your airport journey. For more information, Visit here-: https://upgradevip.com/airport....-gurion-airport-tlv/