Comprehensive Physiotherapy Services in Brampton — Heal Better with Queen West Physiotherapy When pain, stiffness, or injury holds you back from living your best life, professional physiotherapy can help you move freely again. At Queen West Physiotherapy, we offer a complete range of physiotherapy services in Brampton designed to restore movement, relieve pain, and improve your overall quality of life. Read More Visit us : https://medium.com/@queenwestp....hysiotherapy/compreh

Discover postsExplore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

High-Quality Hand Stitched Rasp For Detailed Wood And Metal Work

Detailed wood shaping and metalwork require precision tools that deliver control and consistency. Our hand-stitched rasps are crafted for durability, sharpness, and ergonomic handling, making intricate projects easier and more accurate. Clients benefit from superior craftsmanship and reliable performance in every task. Whether for artistic or industrial applications, these rasps provide efficiency and quality results. Purchase Kutzall hand stitched rasps today to enhance your shaping and carving projects with professional precision.

Visit:- https://kutzall.com/collections/hand-rasps

Escada Dresses – Timeless Luxury and Modern Elegance for Every Occasion Discover the world of Escada dresses, where luxury meets contemporary sophistication. Renowned for their flawless tailoring, premium fabrics, and feminine silhouettes, Escada designs exude confidence and elegance. From classic sheath dresses and vibrant prints to glamorous evening gowns, each piece reflects the brand’s signature European craftsmanship. Perfect for work, special events, or casual chic moments, Escada dresses elevate every wardrobe with effortless grace. Explore the latest Escada collections and embrace refined style that never goes out of fashion. Step into luxury with Escada — a celebration of timeless beauty and modern femininity. Read more - https://artemisvaultboutique.b....logspot.com/2025/10/

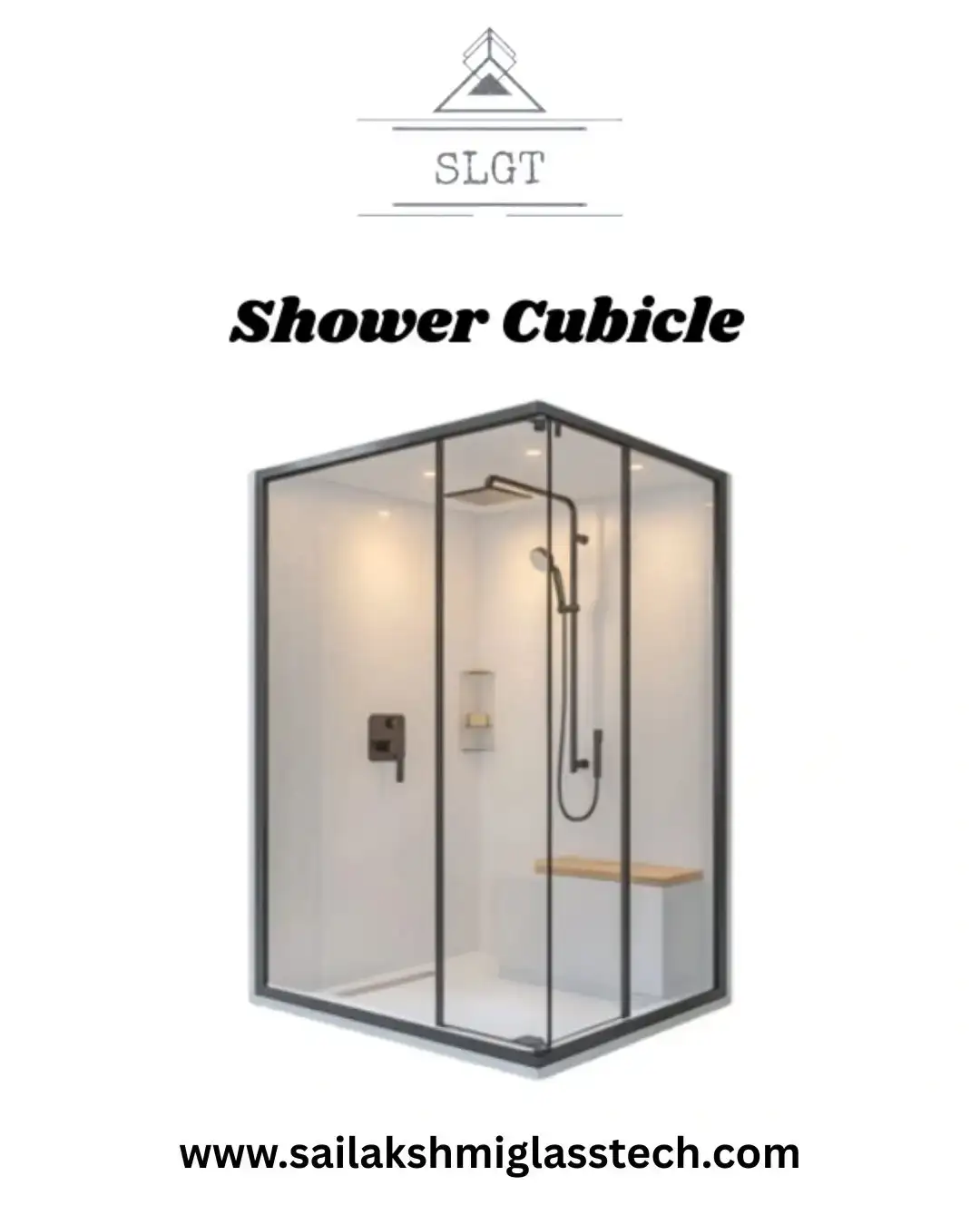

Shower Cubicle Manufacturers in Coimbatore Looking for premium Shower Cubicle Manufacturers in Coimbatore? We specialize in designing elegant, durable, and space-efficient shower enclosures that elevate your bathroom’s style. As trusted Glass Manufacturers in Coimbatore, we offer customized glass solutions crafted with precision, quality, and modern aesthetics to enhance comfort and luxury in every home. For more Visit: https://www.sailakshmiglasstec....h.com/shower-cubicle #glass #door #manufacturers #coimbatore #automaticsensor #laminatedglass #doubleglazed #printedglass #toughenedglass #antislip #sailakshmiglasstech #sailakshmiglasstech02

Appsmith: The Best AI App Builder with Code for Faster Development Create intelligent, custom apps effortlessly with Appsmith, the leading AI app builder with code. This platform lets developers combine drag-and-drop design with JavaScript to build and deploy dynamic AI-powered tools. Whether you’re automating workflows or integrating APIs, Appsmith offers flexibility, speed, and control — perfect for modern teams building smarter applications. Link: https://penzu.com/p/080780beaaf0580a

Read this article to know Step-by-Step process of How to Choose the Right Trademark Class and know checklist before you file your trademark application. https://www.mylegalbusiness.co....m/blog/how-to-choose

Read this article to know Step-by-Step process of How to Choose the Right Trademark Class and know checklist before you file your trademark application. https://www.mylegalbusiness.co....m/blog/how-to-choose

Read this article to know Step-by-Step process of How to Choose the Right Trademark Class and know checklist before you file your trademark application. https://www.mylegalbusiness.co....m/blog/how-to-choose

Najdia Lattafa – Pleasant & Refreshing Perfume Najdia Lattafa Perfume is a soft and fresh fragrance for men and women. It opens with citrus and apple, mixes with gentle cinnamon and lavender, and settles into amber, musk, and sandalwood. Lattafa Najdia Perfume gives a smooth and long-lasting scent that feels natural and pleasant, perfect for everyday use or any special occasion. Visit Now - https://allarabic.in/products/najdia

Are you looking for the installation of Shop Front Roller Shutter? QSF Contractors offers protection and style for your shopfront and secures your commercial premises from vandalism. We provide the best Shop Front Roller Shutter solutions that offer durability and protect your property from theft and harsh weather conditions. Choose QSF Contractors for reliable and affordable Shutter systems to upgrade your premises appearance. https://qsfcontractors.co.uk/shop-front-shutters/